This week, we use AAII’s A+ Investor Stock Grades to provide insight into three retail stocks. With retail sales rising 0.6% month over month, should you consider the three stocks of MINISO Group Holding Ltd. ![]() (MNSO), PDD Holdings Inc.

(MNSO), PDD Holdings Inc. ![]() (PDD) and Vipshop Holdings Ltd.

(PDD) and Vipshop Holdings Ltd. ![]() (VIPS)?

(VIPS)?

Retail Stocks Recent News

The CNBC/NRF Retail Monitor reported that U.S. retail sales rose 0.6% month over month and 5.0% year over year in October, pointing to solid momentum as the holiday season approaches. Core retail sales—excluding restaurants, auto dealers and gas stations—posted the same 0.60% monthly increase and were up 4.89% year over year, highlighting steady consumer demand across most major categories.

Deloitte’s latest holiday forecast added to this positive outlook, projecting 2.9% to 3.4% growth in 2025 holiday retail sales, totaling $1.61 trillion to $1.62 trillion from November through January. Much of this growth is expected to come from e-commerce, with online sales estimated to increase 7% to 9% and reach $305.0 billion to $310.7 billion. Deloitte also noted that disposable personal income is expected to rise 3.1% to 5.4%, providing additional support for consumer spending.

Retail activity’s resilience and forecasted continued strength may offer a reason to explore retail stocks such as MINISO, PDD Holdings and Vipshop.

Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions

Grading Retail Stocks With AAII’s A+ Stock Grades

When analyzing a company, it is helpful to have an objective framework that allows you to compare companies in the same way. This is why AAII created the A+ Stock Grades, which evaluate companies across five factors that research and real-world investment results indicate to identify market-beating stocks in the long run: value, growth, momentum, earnings estimate revisions (and surprises) and quality.

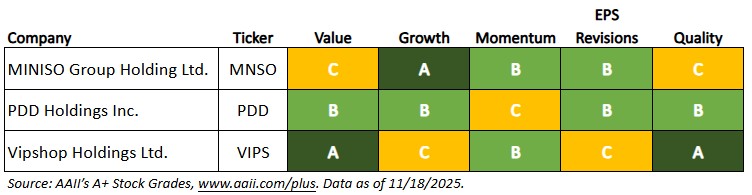

Using AAII’s A+ Stock Grades, the following table summarizes the attractiveness of three retail stocks—MINISO, PDD Holdings and Vipshop—based on their fundamentals.

AAII’s A+ Stock Grade Summary for Three Retail Stocks

What the A+ Stock Grades Reveal

MINISO Group Holding Ltd. ![]() (MNSO), an investment holding company, engages in the retail and wholesale of design-led lifestyle and pop toy products in Mainland China and internationally. The company offers products in various categories, including home decor products, small electronics, textiles, accessories, beauty tools, toys, cosmetics, personal care products, snacks, fragrances and perfumes, and stationeries and gifts under the MINISO brand. It also offers blind boxes, toy bricks, model figures, model kits, collectible dolls, Ichiban Kuji and other popular toys under the Top Toy brand. Additionally, it engages in brand licensing activity and online sale of lifestyle products. MINISO was founded in 2013 and is based in Guangzhou, China.

(MNSO), an investment holding company, engages in the retail and wholesale of design-led lifestyle and pop toy products in Mainland China and internationally. The company offers products in various categories, including home decor products, small electronics, textiles, accessories, beauty tools, toys, cosmetics, personal care products, snacks, fragrances and perfumes, and stationeries and gifts under the MINISO brand. It also offers blind boxes, toy bricks, model figures, model kits, collectible dolls, Ichiban Kuji and other popular toys under the Top Toy brand. Additionally, it engages in brand licensing activity and online sale of lifestyle products. MINISO was founded in 2013 and is based in Guangzhou, China.

The company has a Value Grade of C, based on its Value Score of 57, which is average. Higher scores indicate a more attractive stock for value investors and, thus, a better grade. The Value Grade is the percentile rank of the average of the percentile ranks of the price-to-sales (P/S) ratio, price-earnings (P/E) ratio, price-to-book-value (P/B) ratio, price-to-free-cash-flow (P/FCF) ratio, shareholder yield and the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization (EBITDA).

MINISO has a shareholder yield of 3.4%, which ranks in the 24th percentile among all U.S.-listed stocks. Additionally, its price-to-sales ratio is 0.35, which ranks in the 14th percentile and is below the sector median of 0.65. This favorable ratio suggests that MINISO’s stock may be relatively cheap compared to similar companies in its sector.

MINISO has a Momentum Grade of B, based on its Momentum Score of 61. This means that the stock’s momentum is strong in terms of its weighted relative price strength over the last four quarters. The weighted four-quarter relative strength rank is the relative price change for each of the past four quarters, with the most recent quarterly price change given a weight of 40% and each of the three previous quarters given a weight of 20%. The ranks are 45, 53, 48 and 89, sequentially from the most recent quarter. The weighted four-quarter relative price strength is 0.7%.

The components of the Growth Composite Score consider a company’s success in growing sales on a year-over-year and long-term annualized basis and its ability to consistently generate positive cash from its core operations. MINISO has a Growth Grade of A, which is very strong. The company has generated positive annual cash from operations in the past five consecutive years. In addition, its five-year annualized sales growth rate of 12.9% is above the sector median of 5.5%.

PDD Holdings Inc. (PDD) is a multinational commerce group that owns and operates a portfolio of businesses. It operates the Pinduoduo platform, which provides various product categories, including agricultural produce, apparel, shoes, bags, mother and childcare products, food and beverages, consumer electronics, electronic appliances, furniture and household goods, cosmetics and other personal care items, sports and fitness, and auto accessories. It also operates the online platform Temu, which enables merchants to streamline their manufacturing and commercial operations. The company was formerly known as Pinduoduo Inc. and changed its name to PDD Holdings Inc. in February 2023. PDD Holdings was incorporated in 2015 and is based in Dublin, Ireland.

A higher-quality stock possesses traits associated with upside potential and reduced downside risk. Backtesting of the Quality Grade shows that stocks with higher grades, on average, outperformed stocks with lower grades from 1998 through 2019.

The A+ Quality Grade is the percentile rank of the average of the percentile ranks of return on assets (ROA), return on invested capital (ROIC), gross profit to assets, buyback yield, change in total liabilities to assets, accruals to assets, Z double prime bankruptcy risk (Z) score and F-Score. The score is variable, meaning it can consider all eight measures or, should any of the eight measures not be valid, the valid remaining measures. To be assigned a Quality Score, though, stocks must have a valid (non-null) measure and corresponding ranking for at least four of the eight quality measures.

PDD Holdings has a Quality Grade of B, with a score of 78, which is strong. The company ranks strongly in terms of its return on assets and return on invested capital. PDD Holdings has a return on assets of 31.3% and a return on invested capital of 48.1%. This is partially offset by its –1.9% accruals-to-assets ratio, ranking in the 31st percentile of all U.S.-listed stocks.

PDD Holdings has a Value Grade of B, based on a score of 77, which is good value. The company ranks in the 16th percentile for its price-to-sales ratio and in the 25th percentile for its price-earnings ratio. The company has a price-to-sales ratio of 0.41 and a price-earnings ratio of 11.5. A lower price-to-free-cash-flow ratio is considered better value, and PDD Holdings has a price-to-free-cash-flow ratio of 1.4. The enterprise-value-to-EBITDA ratio is 4.9, which ranks in the 9th percentile.

The company has a Momentum Grade of C, based on its Momentum Score of 49. This means that the stock’s momentum is average in terms of its weighted relative price strength over the last four quarters. The ranks are 49, 51, 52 and 70, sequentially from the most recent quarter. The weighted four-quarter relative price strength is –2.6%.

Don’t Miss Your Free Report — Sign Up Here!

Vipshop Holdings Ltd. ![]() (VIPS) operates online platforms in the People’s Republic of China. It operates through the Vip.com, Shan Shan Outlets and others segments. The company provides womenswear; menswear; sportswear and sporting goods; shoes and bags; accessories; baby and children products; skincare and cosmetics; home goods and other lifestyle products; and supermarket products. It also provides internet finance services, including consumer and supplier financing. In addition, the company engages in warehousing, retail business, product procurement, and software development and information technology support activities. It provides branded products through its Vip.com and Vipshop.com online platforms, as well as through retail stores. Vipshop was founded in 2008 and is headquartered in Guangzhou, China.

(VIPS) operates online platforms in the People’s Republic of China. It operates through the Vip.com, Shan Shan Outlets and others segments. The company provides womenswear; menswear; sportswear and sporting goods; shoes and bags; accessories; baby and children products; skincare and cosmetics; home goods and other lifestyle products; and supermarket products. It also provides internet finance services, including consumer and supplier financing. In addition, the company engages in warehousing, retail business, product procurement, and software development and information technology support activities. It provides branded products through its Vip.com and Vipshop.com online platforms, as well as through retail stores. Vipshop was founded in 2008 and is headquartered in Guangzhou, China.

Vipshop has a Quality Grade of A, based on a score of 97, which is very strong. The company ranks strongly in terms of its return on assets, buyback yield and F-Score. Its return on assets is 9.9%, ranking in the 87th percentile. Its buyback yield of 7.5% ranks in the 95th percentile among all U.S.-listed stocks. Its F-Score of 5 ranks in the 50th percentile. The F-Score is a number between 0 and 9 that assesses the strength of a company’s financial position. It considers the profitability, leverage, liquidity and operating efficiency of a company.

The company’s Growth Grade is C, which is average. Vipshop has generated positive annual cash from operations in the past five consecutive years and has a five-year annualized sales growth rate of 2.1%.

Earnings estimate revisions indicate how analysts view a firm’s short-term prospects. Vipshop has an Earnings Estimate Revisions Grade of C, based on a score of 46, which is neutral. The grade is based on the statistical significance of its latest two quarterly earnings surprises and the percentage change in its consensus estimate for the current fiscal year over the past month and past three months.

Vipshop reported a positive earnings surprise of 2.1% for the second quarter of 2025. In the first quarter, it reported a positive earnings surprise of 2.2%. Over the last month, the consensus earnings estimate for the third quarter of 2025 has remained unchanged at $0.409 per share. Over the last month, the consensus earnings estimate for full-year 2025 has remained unchanged at $2.426 per share.

Included With AAII Platinum

Included With AAII Platinum

at only 6.9%

Since Inception. Data as of 12/31/2024.

769.3% Stock Superstars Portfolio Total Return Since Inception

U.S. Index ETF (IYY)

SSR Group 3 O'Shaughnessy portfolio has a 411.2% gain since inception performance compared to IYY at only 119.1%% Performance as of 11/29/24.

FREE REPORT

BECOME A MEMBER FOR ONLY $2

Get access to powerful investment discovery tools and a wealth of investment education to help you achieve your financial goals.